2024 SCALP ZERO LEVEL v.2.02 trading robot for Meta Trader 5 (release dated December 05, 2023)

This scalper is tested in real trading at forex brokers:

- FxPro - leverage 1:1000, 1:500, 1:200

- SWISSQUOTE - leverage 1:400, 1:200

- Alpari - leverage 1:1000, 1:500

- RoboForex - leverage 1:1000, 1:500

Online monitoring of real trading Scalp Zero Level

Trade Start 03/01/2024

|

Trade Start 03/01/2024

|

Scalp Zero Level + News Insider

|

DESCRIPTION: FOREX SCALPER SCALP ZERO LEVEL

You can rent or buy an unlimited license here, on our website forexrobot.pro or on the . MQL5.

You can copy our trade using Scalp Zero Level forex scalper in MQL5, START SIGNAL services.

1. Introduction:

100% automated trading system that requires no manual intervention.

Scalp Zero Level is a unique Forex robot that is based on a scalping strategy using key levels in specific time windows within the day. The robot gives traders the opportunity to enter the market through pending orders at certain moments of the Asian, European and American exchange sessions.

2. Basic principles of work:

Session time windows: Scalp Zero Level examines three intra-day time windows - Asian, European and American sessions - and identifies key levels for market entry.

Pending orders: The robot uses pending orders like SellLimit, SellStop, BuyLimit and BuyStop to enter the market at the moments defined by the algorithm.

Maintenance modules: Profitable positions are accompanied by follow-up modules including "position lifetime in the market", SmartTrail, "TargetProfit", "EndDayProfit" and physical take profit.

Risk management: Risk is managed by setting StopLoss at 50 to 100 pips. The robot avoids risky methods such as martingale and leveraged averaging.

Profitability: each trading setup has in its name the percentage of annualized return and the amount of risk (GBPUSD ProfitYear 227%, PF2.0, DD12%, PL 6-1). The average risk ratio is approximately 1k10 for every 10% probability of closing a position at StopLoss =1%. The average annualized return on the provided trading setups is 50-100% per year and the risk is 4-8%. Accordingly, the expected annual return on the supplied trading settings is 50% x 16 (currency pairs) = 800% - 1600% per year*.

*The return is given taking into account reinvestment of the profit.

|

|

|

3. Features: Scalp Zero Level forex robot

Visualization and time windows: The robot visualizes key levels and time windows on currency pair charts for trader's convenience.

Flexibility of timeframes: Scalp Zero Level can work on any chart time frame, allowing traders to choose the optimal time frame for their strategy.

Multicurrency: EURUSD, GBPUSD, USDJPY, AUDCAD, USDCAD, CADJPY, EURGBP, AUDUSD, EURJPY, AUDCHF, USDCHF, NZDUSD, AUDJPY, NZDCAD, CHFJPY, NZDJPY, EURCHF. The robot supports trading on all major, minor and cross-currency pairs, providing traders with a wide range of choices. Average profit from each deal 30 - 100 pips. 1% of the account balance is used to open a deal on each currency pair, approximate profit of 1-2% from each deal.

4. Reliability:

Scalp Zero Level is a reliable and flexible forex robot designed for traders looking for an efficient way to scalping in the forex market. Through the use of key levels and strict risk management, this robot provides reliable trading solutions on a variety of currency pairs and timeframes.

5. Key Levels in Trading:

This strategy is implemented in the Scalp Zero Level forex robot, providing traders with the ability to trade the market with confidence based on key levels and market psychology.

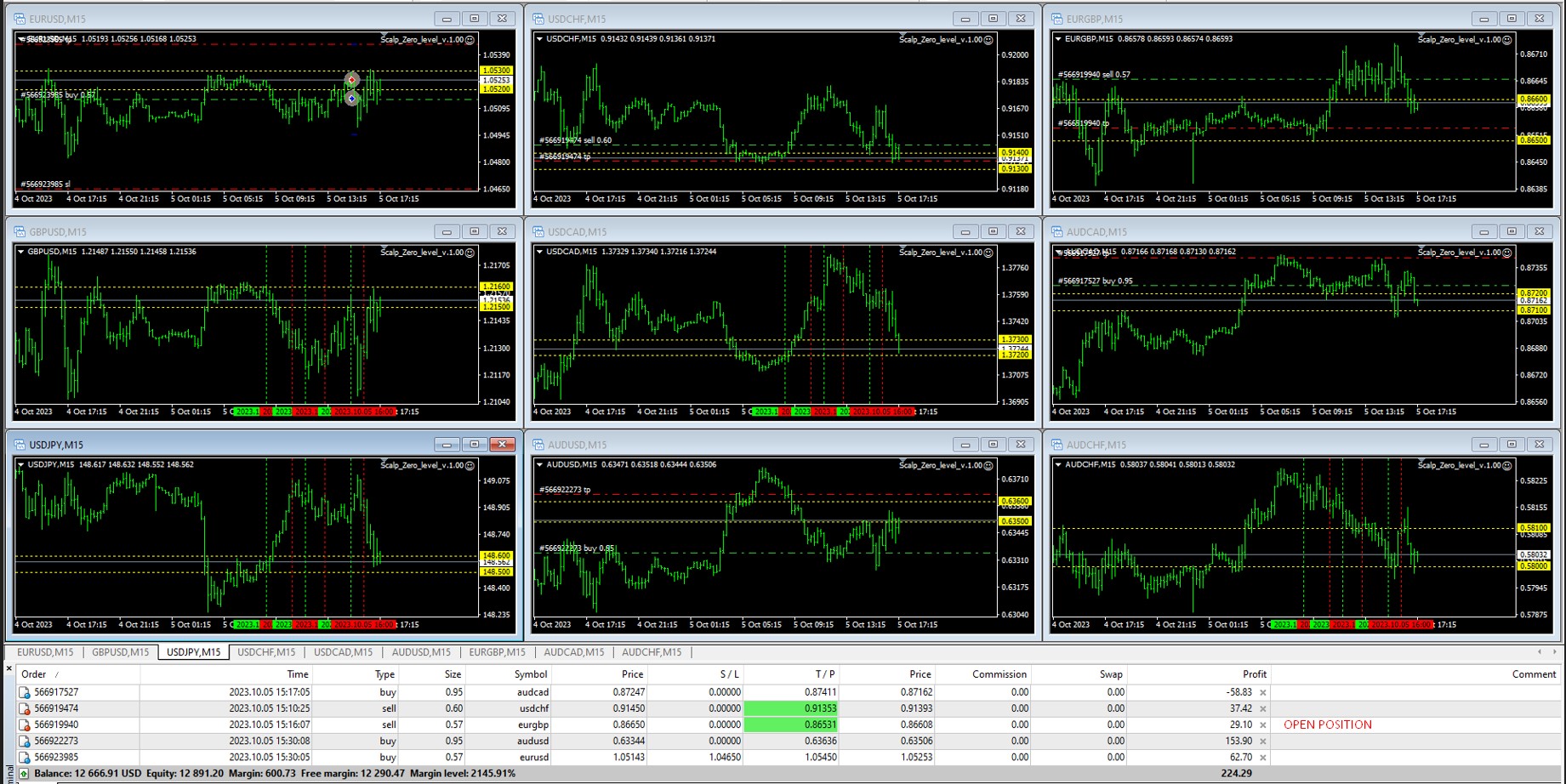

Stress test results in real trading, in October 2023, prior to the start of sales.

Statistics:

Participation rate, profit-risk ratio and average time of holding a position in the market by currency pairs.

Participation rate, profit-risk ratio and average time of holding a position in the market by currency pairs.

Statistics of profitability for the stress test period.

This scalper is tested in real trading at forex brokers:

- FxPro - leverage 1:1000, 1:500, 1:200

- SWISSQUOTE - leverage 1:400, 1:200

- Alpari - leverage 1:1000, 1:500

- RoboForex - leverage 1:1000, 1:500

Expected return, growth of balance in a year with reinvestment of the received profit.

Expected return, monthly account balance increase.

Trading instruments, currency pairs used for trading in the presented strategy.

Few trading options exist for the potential losses limitation.

StopLoss - closure of loss making position by predetermined level in percents from the deposit, or in points range. This option is considered the most safe in trading.

Hedging - partial of full overlap of loss making position on account of profits gained with closed positions, in any direction and any traded instrument.

Averaging/breakeven - additional averaging position opening, in the same direction as loss making position. Following closure of all positions taking part in averaging, in total profit. This method is considered one of the most risk involving, with constant growing load of the deposit, in case if the trend is moving against the opened positions.

Martingale - averaging positions opening with exponential lot volume increase, in relation to previous loss position opened in the same direction. This method is considered the most risk involving, but at the same time, one of the most effective as well, if there is no long term trends on the market, such periods known as "flat market". We don't recommend to disregard the risk management recommendations, not to exceed the coefficient to more than 1.5 - 2.

Lock - market position opening on set range in points or in percents from the deposit amount. Lock position is opened in opposite direction from the loss making position, with the same volume, or with the same lot exponent. Volume of the lock position depends of the algorithm of trading strategy, and a purpose of the lock position in this strategy. Lock position can be used to prevent the deposit from drawdowns with trend reversals with following withdrawal in profit.

- StopLoss in points

Trading account type - Brokers are offering different account types with different trading conditions. One of them is difference in provided market price feed.

Standard - 4 digits past comma, in format of 1,1234.

Extended - 5 digits past comma, in format of 1,12345.

When determining the range of price movement in points, in analytics, projections and discussions, four digits after comma is taken into account.

Example : price went from 1,20002 to 1,30007, it means that the price change for 100 points(one figure). If to say that the price is in this case went for 1005 points, it will be wrong. As the fifth digit is not a whole point, but one tenth of a point.

- Extended - 5 decimal places (1,12345).

- Standard - 4 decimal places (1.1234).

2.02

2.01

1.0

The first version of forex scalper for Meta Trader 5 trading terminal has been released. This version is available for monthly rental or unlimited license purchase. Up-to-date trading settings are included in the package.

20/12/2021, 16:03

18/12/2021, 08:31

11/01/2021, 21:33

12/11/2018, 21:24

08/06/2016, 22:45